real estate asset classes uk

Together the investment strategies of Schroders funds cover a broad range of asset classes. Ill also point out some of the key sub-asset classes which exist and how they differ.

Understanding Risk Factor Diversification Pimco

Co-working offices offer a more flexible solution to freelancers entrepreneurs and organizations compared to traditional office spaces.

. MSc Real Estate Asset Management is a fast-track conversion course that will allow you to gain the necessary framework of knowledge understanding and skills to enable you to pursue a successful career in real estate asset management in the UK or internationally. UK asset class returns. Core course units are shared with our MSc Real Estate.

But information available can be either incorrect or difficult to understand. An asset class is a group of securities that exhibits similar characteristics behaves similarly in the marketplace and is subject to the same laws and regulations. Asset classes in real estate are better understood if you think of them as alternative assets that fall into a.

Job Description How to Apply Below. StepStone Infrastructure Real Assets provides tailored solutions to help meet the needs of institutional investors at any stage of their investment programs. They are typically traded in the same financial markets and subject to the same rules and regulations.

As of June 2020 listed office real estate companies had a market capitalization of 666 billion euros while multifamily housing companies. We offer one of the broadest suite of services in the global infrastructure marketcovering fund investments secondaries co-investments separate accounts and ongoing asset management. An asset class is a group of similar investment vehicles.

Schroders managed real estate expertise stretches back to 1971 and since then has been consistently recognised by the real estate industry for its outstanding performance. UK Select a region. Multifamily properties are often further.

Making an allocation to bullion should be a prime consideration when you look for help to offset the equity interest-rate and real-estate risk of a broader well-balanced investment portfolio. BlackRocks US 60 billion real assets teams helps our clients meet their investment goals by providing a distinct range of well defined outcome orientated strategies along the investment risk-return spectrum covering equity debt and listed real assets globally. Additionally two common alternative asset classes are commodities and as you may have guessed real estate.

Schroders real estate fund managers now have 213 billion of gross real estate assets under management in a broad range of liquid open and closed-ended funds. They are now looking for an experienced Real Estate Associate to work on investment opportunities across Europe. Figure 1 Summary of UK operational real estate asset classes Source Savills Research using ONS RCA EAC UK Operational Real Estate Student Accommodation PBSA Build to Rent BTR Retirement Living RL Size and potential Target market Full-time students Households in the private rented sector Over 75s Size of target market 2019.

Citizens of the UK are the most likely in the world. 8 Types of Commercial Real Estate Buildings Properties. Whats the Cheapest Asset Class.

Underlying asset type whether thats stocks bonds or other assets such as real estate commodities etc. Bn into European Real Estate in the next 2 years from several funds focused across a range of strategies including distressed assets development projects and manage-to-core. The business manages US25 billion of assets across two distinct investment strategies - core core plus.

Although a slightly dated investment principle it. Real Estate Associate - Acquisitions and Asset Management French or German Speaker OUR CLIENT is a pan-European real estate investment company who invest in a variety of asset classes. Three traditional asset classes are equities or stocks cash equivalents or a Money Market and fixed income or bonds.

Equities fixed income multi-asset alternatives real estate and responsible investment. Its also one of the bestand easiestfor new investors to crack. As an investment asset class property or real estate refers to commercial property that delivers returns in the shape of rent and the appreciation of building values.

Whether youre a budding real estate investor or just curious to learn more about investing heres a crash course on real estate asset classes versus property types and what. If you wanted to invest in technology companies in China bonds in Europe gold or real estate you wont find those options in the SP 500. They work with all asset classes in Real Estate and have key focuses in the UK Ireland Spain Italy Germany the Nordics.

Broadly speaking the universe of investment options can be broken down by. Different classes or types of investment assets such as fixed-income investments are grouped together based on having a similar financial structure. Whats a Good Asset Mix.

Property investment continues to play a huge role in sustaining the economy of the United Kingdom. Understanding the difference between the real estate asset classes and property types is key for investors in the space. Real estate market cap in the UK 2020 by asset class.

Real Estate Asset Classes. Everything You Need to Know Before Investing in 2022. The least liquid asset classes are land real estate private equity and artworks.

For each asset class in bold I will provide a brief explanation of the risks the rewards the liquidity characteristics and give an indication of an appropriate minimum time horizon to hold each investment. Of all alternative investments real estate is one of the most common. The real estate investment industry is broken into various property types and classes and you can evaluate these to see.

Listed below are six of the hottest alternative real estate asset classes which are gaining attention from institutional investors worldwide. The three main. Real estate and infrastructure.

US annual asset performance comparison 1972-2021. The team consists of approximately 230 high performing and motivated employees across circa 20 cities globally. The co-working office owner or operator.

That at an auction last Tuesday Britain sold 700 million of the bonds maturing in 2047 at a real yield of -0116 with investors. According to a recent survey approximately one-third of UK adults agree that property will be the best performing asset in 2022 with investors favouring it over stocks cash and cryptocurrency. A common asset allocation is 60 in stocks and 40 in bonds.

The cheapest asset classes include small-cap equities affordable ETFs and commodities. The term multifamily real estate comprises all residential real estate with the exception of single-family homes. Macquarie Asset Management Real Estate is a global investor and manager of real estate assets.

This type of commercial real estate includes high-priority investments like apartments co-ops townhomes and more.

Basic Asset Allocation Models Forbes Advisor

/GettyImages-172140833-0ec83a164662418ba5940cdede6a3b3e.jpg)

Diversification It S All About Asset Class

How To Invest In Reits In The Uk Raisin Uk

How To Invest In Real Estate Forbes Advisor

Commercial Property Market Size Uk 2021 Statista

/real-estate-investing-101-357985-final-5bdb4da04cedfd0026ac6b3f.png)

Real Estate Investing Tips For Beginners

Understanding The Real Estate Asset Class Property Types And Property Classes 2022 Bungalow

Real Estate Private Equity Career Guide

Asset Class Overview And Different Types Of Asset Classes

Allianz Real Estate Allianz Real Twitter

Commercial Property Market Size Uk 2021 Statista

Real Estate Private Equity Career Guide

:max_bytes(150000):strip_icc()/dotdash_FINAL_Diversification_Its_All_About_Asset_Class_Jan_2020-fe0eea99d53d4883824b1859f899627c.jpg)

Diversification It S All About Asset Class

6 Key Alternative Real Estate Asset Classes The Fintech Way

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

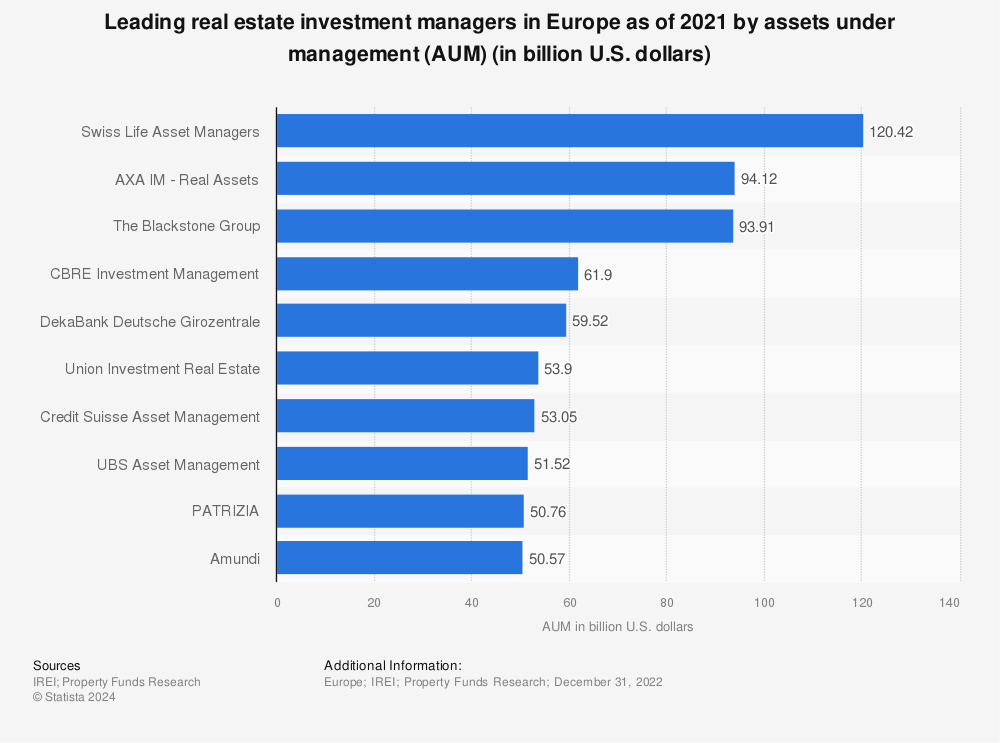

Leading Real Estate Investment Managers By Aum Europe Statista